SNOWMOBILE

POLICY ANALYSIS

(May 2019)

|

|

Snowmobiling is an activity that

is popular in many

|

State |

Registered Snowmobiles |

|

|

|

66,310 |

|

|

|

13,400 |

|

|

|

34,200 |

|

|

|

42,018 |

|

|

|

19,247* |

|

|

|

9,646 |

|

|

|

21,061 |

|

|

|

80,500 |

|

|

|

16,160 |

|

|

|

188,952 |

|

|

|

183,354 |

|

|

|

23,855 |

|

|

|

775 |

|

|

|

43,000 |

|

|

|

112,022 |

|

|

|

9,114 |

|

|

|

12,400 |

|

|

|

13,150 |

|

|

|

33,240 |

|

|

|

11,407 |

|

|

|

20,398 |

|

|

|

20,648 |

|

|

|

22,882 |

|

|

|

230,630 |

|

|

|

30,276 |

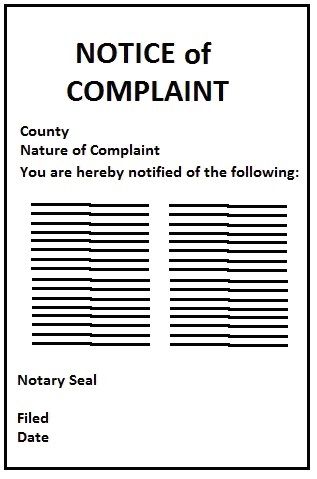

A common method for handling the

needs of a snowmobile owner is to modify his or her automobile policy. This

analysis discusses the Insurance Services Office's (ISO) '18 edition of the

Personal Auto Policy, as modified by the PP 03 20–Snowmobile Endorsement. This

analysis discusses a full PAP form with language altered via the above

endorsement rather than merely discussing the optional coverage form.

Changes from the ’05 edition of the Personal Auto Policy, as modified by the PP 03 20–Snowmobile Endorsement are in bold print.

Related Article: Snowmobile Liability Not Covered In a Homeowners Policy

SCHEDULE

Each snowmobile to be covered by this endorsement must be scheduled (separately described).

|

Example: Farina’s auto policy has a snowmobile endorsement as follows: Auto Policy ABCD1234 is amended to extend this policy’s liability and physical damage coverage to: |

|||||

|

Snowmobile |

Serial Number |

Horsepower |

Phys. Dam. Limit |

Liability Limit |

Premium |

|

Artic Cat Grabber (ski-doo) |

sxany3114554 |

220 |

$3,100 |

$100,000 |

$42 |

|

IceCast 3000 Snowmobile |

Mnnu8er977 |

250 |

$4,800 |

$100,000 |

$71 |

The PP 03 20 Snowmobile Endorsement has a schedule which includes the following areas:

- Description section for listing details (name, model, identification numbers) for up to three snowmobiles

- Check boxes for making a specific choice for passenger hazard coverage – the choice is separate for each described snowmobile

|

|

Example: The Winteralls have a snowmobile policy with three

snowmobiles. On snowmobiles one and two, they select the passenger hazard

option. On snowmobile three, which is a small model only capable of handling

a single person, they choose to exclude the passenger hazard. |

- Areas for showing selected limits for liability (BI/PD), Medical Payments, Uninsured Motorists, Collision and Other than Collision coverages, including separate limits, premiums and, if applicable, deductibles.

- Areas for entering a total value for each, described snowmobile under the collision and other than collision coverages – but these amounts are subject to the form’s settlement provisions.

DEFINITIONS

This section precedes the policy's coverage parts and consists of the following defined terms:

A. The policy uses the terms "you" and "your" in reference to the "named insured" shown in the policy declarations (or schedule) and the named insured's spouse (if the spouse lives in the same household). Under limited circumstances, a spouse maintains insured status when he or she leaves the covered household. Coverage is granted until the earliest of the following occurs:

· The spouse has been out of the household for 90 days

· The spouse gets a policy in his or her own name

· The policy period ends.

|

Example: An insured and her spouse are insured under a snowmobile policy with a term of 5/2/18 to 5/2/19. On 7/5/18, the couple split up, with the husband leaving (the wife was the named insured). The husband buys a Snowscreamer 3000. Scenario 1: The purchase is on 7/6/18. The new snowmobile is covered under the wife’s policy as newly acquired subject to the reporting requirements. When the husband purchases a snowmobile policy in his name, all coverage for the husband ends on the wife’s policy. Scenario 2: The purchase is on 10/8/18. The new snowmobile is not covered under the wife’s policy because the husband has been out of the house for more than 90 days and no longer qualifies under the definition of “you” or “your” under the wife’s policy. |

B. The terms "our," "us" and "we" mean the company that issues and maintains the snowmobile coverage.

C. The snowmobile policy considers any "snowmobile" to be an owned snowmobile if there is a written lease that covers a period of six months or longer.

D. "Bodily injury" refers to sickness, disease, or bodily harm. This definition even includes death if it is a direct result of sickness, disease or bodily harm.

|

Example: Klarence is insured under a snowmobile policy. While

riding along a snow-covered trail, he slams into a group of hikers. A couple

of months later, Klarence gets a notice from a lawyer. He represents the

family of one of the injured hikers. The family is suing Klarence for medical

treatment and related expenses. Three weeks after the initial notice, he hears

from the same lawyer. The family's suit has been amended since the injured

hiker died from collision-related wounds that became infected. |

|

E. "Business" means any trade, profession or occupation. In other words, it is any regular activity that generates income.

F. A "family member" is any person who is a relative by blood or by marriage. Any persons who are adopted, wards or foster children qualify as "family members," but only for as long as they reside in the same household as the named insured or spouse.

G. "Occupying"

This term refers to a snowmobile that someone is in, upon, getting in, getting on, getting out or getting off, as occupying a snowmobile.

Naturally, how this item is interpreted can be the source of lawsuits.

|

Example: Jeremy is sued by his former buddy Nick who is trying to

recover his medical and rehab expenses stemming from a serious back injury.

Jeremy’s snowmobile insurer is disputing the loss. Jeremy and Nick had been

riding on Jeremy’s snowmobile when they took a break and parked the vehicle.

While throwing snowballs at each other, Nick rushed Jeremy’s position behind

the parked snowmobile and was injured when he leapt onto it and it fell over.

The insurer filed a motion that it had no responsibility for the loss as the

injury had nothing to do with the ordinary use of the snowmobile. |

H. "Property damage" means the loss of use of, damage to or destruction of tangible property.

Eligible snowmobile losses do need a direct connection to a covered snowmobile’s use or operation. In any case, a lack of physical involvement makes coverage questionable.

|

Example: Nina is excited about her annual Snowfest party. She

expects a huge crowd at the party tent located in the middle of her 4-acre

property. She hooks up her “Snowfest Party Sled,” a huge box that has large

skis attached to it. It is homemade and, for years she has used it to

transport beverage and food from her house to the party tent. Though homemade,

it would still qualify as a trailer. |

J. The definition of “your covered snowmobile” is any of the following:

· A snowmobile described in the policy including the policy schedule

· A snowmobile an insured secures after the policy period begins

· A snowmobile that, while not owned by an insured, is used as a substitute for a covered snowmobile.

Note: The substitution has to be due to the other snowmobile being serviced, repaired, lost or destroyed.

|

Examples: |

|

- a, ‘11 Snow Leopard the

insured borrowed from his neighbor while his snowmobile is having its treads

repaired |

|

- the ‘12 Winter Cat (snow

ski) that is a “loaner” from a repair shop which is repairing minor cracks

and re-painting the insured’s snowmobile |

|

If the operator caused an

accident during the above situations, this would qualify as a covered

snowmobile for injury or damage caused to other parties. |

Note: The definition section on substitute snowmobiles (definition J.4) does not apply to situations involving collision and other than collision coverage.

K. Newly acquired snowmobile

This term applies to a snowmobile that any insured obtains possession of during the policy period (but after the policy period's inception date).

|

Example: Jessi Winternutz has a brand-new snowmobile policy with a policy period of February 10, 2019 to August 10, 2019 and it covers a ‘13 Ice-Trekker. Given this information, which of the following qualifies as a newly acquired snowmobile?

|

However, even if an additional snowmobile clears the type, use and date of acquisition hurdles, there are other requirements. Part K.2. covers the issue of when to report an additional snowmobile to the insurance company. The timing of reporting the snowmobile has a direct impact upon coverage.

The 09 18 edition PAP

when it forms the base of the snowmobile policy removes a reference that made a

distinction between newly acquired snowmobiles that replace an existing snowmobile

and those that are additional snowmobiles. Previously, the 14-day reporting

window only applied to additional snowmobiles. Now, the reporting requirement

applies universally. This is a significant reduction in coverage. (09 18 change)

Related Article: Personal Auto Policy Coverage Analysis - See the "Newly Acquired Auto" discussion

L. “Transportation network platform”

This term refers to certain online transportation

services. Specifically, it means any such service that is accessed through a

mobile electronic device application or through a digital network. The service

must involve matching riders to drivers who are compensated for picking up and

transporting persons between agreed-upon locations. (09 18 addition)

This is a new, defined term, added to align with the revisions made to the PAP in response to the exposure from ride-on-demand services that have arisen and become common in recent years.

SNOWMOBILE

POLICY ADDITIONAL DEFINITIONS

This policy also defines the following:

Snowmobile - refers to motor vehicles, operated primarily off public roads while such roads are snow and/or ice-covered. Several methods of propulsion are permitted, such as wheels, treads or belts. However, fan (propeller) or jet propulsion does not qualify as a snowmobile.

A trailer that is capable of being towed by a covered snowmobile also qualifies for coverage.

Note: Trailers designed for transporting a snowmobile are ineligible for coverage.

Declarations – also includes any schedule used with the snowmobile policy.

PART A -

LIABILITY COVERAGE

Insuring

Agreement

The snowmobile policy covers both "bodily injury" and "property damage" for which a covered person is legally obligated to pay because of an accident. The agreement also obligates an insurer to defend a claim or lawsuit. However, once the policy's limit of liability has been exhausted, the insurer's obligation to continue paying to legally defend an insured ends.

|

|

Example: Phil Skiwrong is being sued for hitting another

snowmobiler after Phil ignored safety signs and entered another trail. Phil’s

insurer defends his suit and dutifully pays lawyer fees and court costs.

Phil’s policy has a combined single liability limit of $100,000. The claimant

is suing for $300,000 in damages and her claim is bolstered by a very

credible group of snowboarders who witnessed the event. After a careful

evaluation of the case, Phil’s insurer determines that it would be fruitless

to refute the amount of damages being claimed. The insurer decides to save on

its defense costs and to pay out the full policy limits. The claimant accepts

their payment but continues the suit for the additional damages. The cost of

continuing any defense is now Phil’s responsibility. |

The fact that an insurer can decide to settle a claim when facing very high defense costs may not seem fair, but it is necessary. The snowmobile policy contains the potential of an unlimited defense obligation. It has no specific monetary limit on the amount paid to defend a covered person. However, the policy does allow a company to have some control over their financial duty to protect a covered person in a given claim. Of course, a natural control against an insurer’s unlimited obligation to defend an insured is that a company does not have to provide a defense under ALL situations. An insurer doesn’t have to defend any "bodily injury" or "property damage" loss that isn't covered by the policy.

|

Example: Billie Roadmaster is quite an aggressive driver and he’s

usually in a big hurry, even when snowmobiling. One morning he became enraged

at some skiers who were, in his opinion, taking too long to cross a trail. To

show them how upset he was, he guns his snowmobile, flies past them and then

drives his snowmobile in increasingly tighter circles around them. Most of

the skiers, though not hit by the snowmobile, are seriously injured in the

attempts to avoid Billie's machine and several skiers file lawsuits. Billie’s

insurer tells him that his snowmobile policy will not pay for any claim NOR

defend him in court. |

Under Part A - Liability Coverage, an insured includes:

1. You, any "family member,"

2. Any person using "your covered snowmobile."

|

Example: Yannick Petrie’s ‘14 Flakebuster is insured under a

snowmobile policy. One day, a friend tells him he is going to a recreational

resort for a weekend and asks if he can borrow Yannick's snowmobile. During

the weekend, the friend causes a collision with the Flakebuster, injuring

another snowmobiler and his machine. Since the friend is a permissive

operator of Yannick’s snowmobile, Yannick’s policy would cover the loss (up

to its limit). |

The snowmobile policy also considers other persons and organizations to be covered persons in certain circumstances.

3. Other persons or organizations are eligible for coverage against damages which they cause, but for which a named insured, a resident spouse or a "family member" is responsible because of their acts or omissions in providing the snowmobile.

|

Example: Jim’s church is having a fundraiser and they are holding

a raffle Jim sets up a display using his snowmobile since it is the same

model as the one to be raffled off.

During the fundraiser, the snowmobile tips over and injures several

children. Jim’s church is sued by their parents. Jim’s insurer would defend

the church for the lawsuits. |

4. Other persons or organizations also are covered for their acts or omissions in providing a snowmobile to a named insured, a resident spouse or a "family member" who causes damages with that vehicle (including a trailer).

Supplementary

Payments

This section advises the insured of several, additional coverages that are available. One supplemental coverage will pay for the cost of bail bonds, but this coverage is limited to a total of $250. However, the bond has to be connected with an accident. A bond that is due solely to a traffic violation isn't covered.

The policy pays for the costs of premiums on appeal bonds and attachment bonds, but only those involved in a suit that the insurance company is defending.

The snowmobile policy pays for loss of earnings caused by hearings or trial attendance and other reasonable expenses caused by an insurance company's request.

|

|

Example: June Unlukki is asked to appear at a preliminary hearing

involving her snowmobile accident where she collided with another

snowmobiler. June gets permission to take an unpaid day off from work to

attend and testify at the trial. The insurer says that they will pay for her

loss of a day’s wages. |

Concerning loss of pay, the snowmobile policy pays a maximum of $250 per day because of lost earnings; this supplemental coverage does not include loss of other sources of income. However, the loss of earnings limit used to be a fraction of the current coverage. The policy also pays for any interest on judgments that have been entered. However, any payment obligation ends if the policy's limit of insurance is reached. . (09 18 change)

Finally, under Supplementary Payments, the policy will pay any reasonable expenses that are due to an activity requested of an insured by the insurer.

|

Example: Sammi Kollum’s insurer is defending a lawsuit filed

against him for a collision that occurred while Sammi was enjoying an

out-of-state vacation. Sammi’s insurer has decided for him to travel to a

lawyer’s office in that state so that he can participate in a deposition. The

insurance company assures Sammi that they will pay for all expenses including

travel, meals, hotels, etc. |

Exclusions

This coverage part's exclusions fall under categories A, having to do with "insureds," and B, which concerns snowmobile ownership, maintenance and use.

Part

A. Exclusions

1. The Snowmobile Policy doesn't provide liability protection to insureds who intentionally injure other persons or property. Because this point sometimes causes confusion, it is important to examine what is meant by intent and even examine whether consequences can be foreseen.

|

Example: |

|

Related Court Case: Unlicensed Driver "Borrows" Grandparents' Van – though this is an automobile situation, it is relevant as it illustrates an operator’s intent during a loss.

2. The snowmobile policy excludes coverage for property damage to property that any insured owns or transports.

|

Example: Pete is zipping across a field from a resort cabin

(rented by Pete and his friend) to the resort’s community hall. His

snowmobile is towing a trailer that is filled with expensive electronic

equipment. He is transporting his friend’s sound system and projection TV to

be set-up in the hall. A group of resort guests are going to hold a community

movie festival. On the way over, Pete’s snowmobile goes over a hidden tree

trunk. The snowmobile and trailer overturn and the equipment is ejected,

ruining it. While the snowmobile policy will dutifully respond to paying

damages to the snowmobile and trailer, it won’t handle the equipment loss. |

|

3. Any property that an insured has rented, uses or is caring for is also without protection if damaged or destroyed.

|

Example: Again, Pete is zipping across a field from his resort

cabin to the community hall. Again, he is towing a trailer that is filled

with his friend’s expensive audio/video equipment. In this instance, he had rented

the trailer for use during his vacation at the resort. Again, he runs over a

hidden tree trunk damaging the snowmobile and trailer and destroying the

equipment. While the snowmobile policy will dutifully respond to paying

damages to the snowmobile, it now fails to respond to the damage and

destruction done to the trailer as well as the equipment. |

4. Exclusion four negates bodily injury coverage to any person who is hurt while working for an insured. However, an exception is made for domestic employees who aren’t covered AND aren’t required to be covered by workers compensation.

5. If an insured is using a covered snowmobile to make money by transporting either people or property, that insured has just made the vehicle ineligible.

This

exclusion has been revised to make coverage intent clearer. It now refers to

the coverage ineligibility when any insured driver is actively using any

vehicle in conjunction with a transportation network platform. Active use means

providing such use as a driver. The exclusion applies both while seeking

passenger contacts and during transporting passengers. (09 18 change)

Besides the long-standing exception that

applies to use of vehicles in traditional pooling arrangements, An additional exception is referenced,

allowing coverage for a vehicle during its use in charity and volunteer

situations. Protection extends to instances of both ownership and operation

during such instances. (09 18 change)

Note: Naturally chances are low that such situations will arise regarding snowmobile use, but the base PAP change will still apply.

Note: For the sake of continuity, we have continued the numbering for the following exclusion. However, under the snowmobile endorsement, this change is just referred to as an amendment to the PAP exclusion section.

6. No coverage is provided if the accident happens while any described snowmobile is used in any business activity.

|

Example: During

heavy snowfalls, Jimmy is paid by a pizza restaurant to make deliveries when

it is difficult for cars to get around town. When Jimmy is involved in an

accident, his insurer points out that there’s no coverage as it occurred

while he was attempting a delivery. |

7. No coverage is provided for a loss involving a snowmobile being used without the operator having a reasonable belief that they are doing so with an insured’s permission. However, this exclusion is moot for use of an owned snowmobile by a family member (as defined by the policy).

8. BI and PD coverage is NOT provided when an insured is also an insured under a nuclear liability policy. This applies even when such a policy has been terminated or has had its coverage exhausted. A policy issued by the Nuclear Energy Liability Insurance Association, Mutual Atomic Energy Liability Underwriters or the Nuclear Insurance Association of Canada is considered a nuclear policy.

9. Bodily injury suffered by any person who is occupying (per the policy’s definition) or is being towed by a described snowmobile is not eligible for coverage IF the applicable snowmobile is subject to the passenger hazard exclusion.

a. There is a written contract under which the vehicle is

part of a personal vehicle sharing program

b. That vehicle is being used by a person other than the named insured or a

family member (as defined) of the named insured who is participating in a

program referenced in 10.a above (09 18 addition)

Part B

exclusions

1. A definite coverage problem exists for any snowmobile that is not a “covered snowmobile,” which an insured either owns or has available for her regular use. Why? Because such a vehicle should either be listed and rated on an insured’s policy, or coverage should exist under another party’s policy. Any such snowmobile that is not listed on this policy is not eligible for protection.

2. Similar to exclusion 1., the snowmobile policy disqualifies any snowmobile that’s not a “covered snowmobile” that a “family member” either owns or has available for their regular use, unless such a vehicle is being either maintained or occupied by a named insured (and/or resident spouse).

|

Example: Jeri’s adult

cousin lives with her. Her cousin received a snowmobile as a birthday gift.

Since the cousin is inexperienced, she has a collision with it on the first

day she takes it out for a ride. Jeri turns in a claim for the loss. However,

since it belongs to her cousin and is not listed along with Jeri’s

snowmobile, the loss is ineligible for coverage. |

3. This exclusion bars coverage for snowmobiles that are involved in any racing activity, including preparations for a race.

4. The snowmobile policy’s liability coverage is not extended to a snowmobile that is rented or leased by any party other than the named insured.

Limit

of Liability

Part A of this provision explains that the monetary limit that appears on the policy declarations page is the maximum amount of coverage that applies to the damages from any single loss. This maximum is not affected by the number of snowmobiles, insureds, or claims involved, or the number of snowmobiles or premiums appearing on the declarations page. This arrangement is true of both bodily injury and property damage claims. The particulars of a given loss may well affect how payments may be distributed, but the maximum remains the maximum.

|

Example: Tony and Kim have a snowmobile policy with the following limits: |

||

|

Bodily Injury |

$100,000/$300,000 |

|

|

Property Damage |

$500,000 |

|

|

Medical Payments |

$10,000 |

|

|

Collision |

$500 Deductible |

|

|

Other Than Collision |

$500 Deductible |

|

|

Uninsured Motorist |

$25,000/$50,000 |

|

|

Just before Kim could say “watch out,” Tony’s ‘14 Custom Snowking slid out of control while trying to pass another snowmobile. Besides hitting that snowmobile, they also hit a second snowmobile and a group of skiers. Following are the resulting claims for damages: |

||

|

Claimant |

BI Claim Amount |

|

|

One |

$103,000 (burns, plastic surgery) |

|

|

Two |

$32,000 |

|

|

Three |

$81,500 (paralyzed) |

|

|

Four |

$44,000 |

|

|

Five |

$67,800 |

|

|

Six |

$48,500 |

|

|

Seven |

$36,500 |

|

|

Total |

$413,300 |

|

|

Snowmobile |

PD Claim Amount |

|

|

One |

$23,000 |

|

|

Three |

$19,600 |

|

|

Total |

$42,600 |

|

|

The above claims under the one accident could be settled in a wide variety of ways. Under bodily injury, all but one of the individual claimants qualify under the per person insurance limits. However, much of the total would surpass the per accident limit. Under property damage, both of the snowmobiles individually qualify for coverage under the insurance limits. Depending upon how the loss is settled, one or more of the claimants may only get partial settlement or could be squeezed out from any coverage at all. |

||

Part B of the Limit of Liability section explains that, regardless of whether coverage exists under more than one coverage part (specifically parts A, B and/or C), no duplicate payments will be made under the snowmobile policy. This limitation means that, even if portions of a single claim qualify for coverage under Part A - Liability as well as Part B - Medical Payments and/or Part C - Uninsured Motorists coverage, an insured will not be paid more than once for any portion of his loss. This clarifies the policy’s purpose to indemnify rather than enrich a claimant for their accidental loss.

Out-Of-State

Coverage

The Snowmobile Policy emphasizes being able to perform in compliance with the legal realities of the environment that surrounds an eligible loss and this provision allows the form to respond to a loss according to a given state’s requirements. Part A.1 of this provision states that the policy will provide a higher limit for bodily injury or property damage liability coverage to meet whatever is minimally required by the state in which a covered loss occurs. Part A.2 indicates that the policy will comply with the minimum amounts and types of coverages that may be required by a state’s compulsory insurance law while the covered snowmobile is being operated in that state.

|

Example: The policy may be written in state A, which requires

combined single limits, and the policy has a limit of $300,000. As it

happens, a loss occurs while the insured is operating a snowmobile on

vacation in state B, which mandates the limit of liability to be applied in

split limits for bodily injury and property damage liability. The snowmobile

policy would respond to the accident by applying the $300,000 maximum

consistent with the split limit requirement, but it would not increase the

maximum available. |

Part B of this provision states that no one is eligible for duplicate payments. In total, this provision makes the policy a much more reasonable coverage document by preventing technicalities to bar or limit coverage because of the different ways that states structure their coverage requirements.

Financial

Responsibility

The Snowmobile Policy, when considered as valid proof of financial responsibility, is to be interpreted as complying with the governing financial responsibility law. This is helpful and flexible since financial obligations required of drivers vary significantly by state.

Related Article: Section Financial Responsibility Limits

Other

Insurance

In the event that other sources of liability insurance exist, the Snowmobile Policy responds on an excess basis, paying only after the primary policy has paid its limit.

|

Example: Let us examine a $10,000 loss that is covered by a Snowmobile Policy and some other source of coverage. Assume that both sources have coverage limits greater than the loss amount. Since the loss involves a snowmobile owned by the insured and the snowmobile policy and the other coverage source offers the same coverage limits. In this case, payment would be: |

|

|

Snowmobile

Policy |

$0 |

|

Other

Coverage Source |

$10,000 |

PART B - MEDICAL PAYMENTS

COVERAGE

Insuring

Agreement

Item A of this coverage part explains that it will pay for necessary medical and funeral services incurred by an “insured” suffering from accidental “bodily injury.” However, the coverage only applies to costs that an insured faces for up to three years from the date of an eligible accident.

The intent is to limit payment to accident-related expenses that actually were paid for services provided no later than three years after an accident.

Item B of this coverage part defines “insured,” for purposes of applying medical payments coverage, as “you or any family member while occupying a snowmobile or being struck by a snowmobile while walking. Further, any person in “your covered snowmobile” is also an insured under this coverage part.

Exclusions

Even if a person is an “insured,” no coverage for “bodily injury” applies under the following circumstances:

1.

If the injury takes place while the snowmobile is being used to transport

persons or property for income. This

exclusion has been revised to make coverage intent clearer. It now refers to

coverage ineligibility when any insured driver is actively using any vehicle in

conjunction with a transportation network platform. Active use means providing

such use as a driver. The exclusion applies both while seeking passenger

contacts and during transporting passengers. (09 18 change)

Besides the long-standing exception that

applies to use of vehicles in traditional pooling arrangements, An additional exception is referenced,

allowing coverage for a vehicle during its use in charity and volunteer

situations. Protection extends to instances of both ownership and operation

during such instances. (09 18 change)

Note: Naturally chances are low that such situations will arise regarding snowmobile use, but the base PAP change will still apply.

2. If the injury happens while the snowmobile is set up and being used as a premise or residence.

3. If it occurs while on the job but only when workers compensation coverage is either available or required for the bodily injury.

4. If the bodily injury happens while an insured is occupying or is hit by a snowmobile that is owned by the insured but not shown on the policy as required; or while an insured is using a snowmobile that is regularly available to the named insured.

5. If the bodily injury happens while an insured is occupying or is hit by a snowmobile that is owned by or is a snowmobile that is regularly available to a “family member.” However, this exclusion doesn’t apply to a named insured or a resident spouse.

6. No coverage applies if bodily injury occurs when the injured person is occupying a snowmobile without the belief that she or he has the snowmobile owner’s permission. (This exclusion is inapplicable in situations involving use of a snowmobile by a family member IF the snowmobile is owned by the named insured.)

7. This item prohibits coverage for bodily injury suffered while in a snowmobile that’s being used in an insured’s “business.”

Items 8 and 9 eliminate coverage for bodily injury caused directly or indirectly by a nuclear weapon, reaction radiation or contamination; or by war, civil war, insurrection, rebellion or revolution.

Exclusion 10 under Part B - Medical Payments Coverage also contains the clarification that denies coverage for injury involving any snowmobile while preparing for or competing in a race or any type of contest regarding speed. Coverage is denied even if the race or contest was totally spontaneous.

11. No coverage is available for BI when it involves a snowmobile that has been rented or leased to any third party.

a. There is a written contract under which the vehicle is

part of a personal vehicle sharing program

b. That vehicle is being used by a person other than the

named insured or a family member (as defined) of the named insured who is participating

in a program referenced in 12.a above. (09 18 addition)

13. This exclusion is also new. It bars

coverage for loss involving flying vehicles, whether flight is their sole

capability or is among their features. (09

18 addition)

Limit

of Liability

Part A explains that the monetary limit that appears on the policy declarations page is the maximum amount of coverage that will apply to the damages from any single loss. This maximum is not affected by the number of snowmobile, insureds, or claims involved, nor the number of premiums appearing on the declarations page. The particulars of a given loss may well affect how payments may be distributed, but the maximum remains the maximum.

Part B of the Limit of Liability section explains that, regardless of whether coverage exists under more than one coverage part (specifically parts A, B and/or C), no duplicate payments will be made under the policy. This limitation means that, even if portions of a single claim qualify for coverage under Part B - Medical Payments as well as Part A - Liability and/or Part C - Uninsured Motorists coverage, an insured will not be paid more than once for any portion of his loss. The purpose of the policy is to indemnify rather than enrich a claimant for their accidental loss.

Note: Please see the example under the Part A - Limit of Liability section for an illustration of this provision.

Other

Insurance

In the event that other sources of medical payments insurance exist, the policy responds on an excess basis, paying only after the other available coverage has paid its limit.

PART C - UNINSURED MOTORISTS

COVERAGE

Insuring

Agreement

Under part A of the insuring agreement, the snowmobile policy agrees to protect an “insured” against “bodily injury” damages caused by an accident with an “uninsured motor vehicle.” In other words, an insured can rely on his own policy to take care of injuries resulting from an accident where the driver who caused the damages doesn’t have the coverage to take care of his/her legal obligation. This coverage part is not bound by any judgment for damages that are determined by a lawsuit that’s filed without the company’s written consent.

Note: This coverage applies in instances involving uninsured motor vehicles including snowmobiles. Other vehicles operated on treads or rails do not qualify as uninsured vehicles.

Part B of the uninsured motorists coverage insuring agreement defines who is considered an insured. An insured includes the named insured and resident spouse, any “family member,” any other person “occupying” “your covered snowmobile,” and any person eligible for payment because of bodily injury damages suffered by an insured.

Precisely what is considered an “uninsured motor vehicle” is the subject of Part C of this section’s insuring agreement. Part C includes the broadest definition of a vehicle. Any “land motor vehicle” or trailer may be an “uninsured motor vehicle” if no bodily injury liability policy or bond applies to the vehicle. Such a vehicle could still qualify as an “uninsured motor vehicle” if a bond or policy does apply but the writer of the coverage denies coverage or becomes insolvent. Finally, a hit-and-run vehicle is also an “uninsured motor vehicle” when it hits the named insured (includes resident spouse) or a family member, or any car occupied by these classes of people, or it hits a “covered auto.”

Although the policy’s definition of an uninsured vehicle is broad, it doesn’t include any vehicle or equipment that either belongs to or is regularly available to the named insured or any family member, or any vehicle owned by a governmental entity. Vehicles used as a residence, vehicles which operate upon crawlers or treads, except for snowmobiles, or vehicles made primarily for off-road use also are disqualified as uninsured motor vehicles.

The logic behind excluding many of the types of vehicles is that the PAP, as modified by the Snowmobile Endorsement, is not designed to handle exposures to losses that should be handled by other types of policies such as automobile, motor home, recreational vehicle or mobile home policies.

Exclusions

Under Exclusion A, the following situations bar coverage for bodily injury:

1. No coverage exists for any insured if he or she is hit by or hit while occupying an owned vehicle (including a trailer) that isn’t protected by uninsured motorists coverage.

2. No family member is covered if they are hit by or occupying a vehicle that is owned by the named insured, but that is covered by any other policy.

Under Exclusion B, no insured qualifies for uninsured motorists coverage if a bodily injury claim is settled without the company’s consent, the insured is in a vehicle that’s transporting people or property for pay, or if the vehicle was being used without permission. However, the question of permission does not apply to a “family member” who is operating a vehicle that qualifies as a “covered auto.”

Exclusions C and D explain that no coverage exists if coverage should be handled by either workers compensation or disability benefits law, and that payments are not made for punitive or exemplary damages.

There is no coverage while an insured is in a snowmobile rented or leased to someone other than the named insured.

Coverage also is lost for injuries involving a snowmobile that is used in a race or any type of contest regarding speed. Coverage is denied even if the race or contest was totally spontaneous. Coverage is also denied if the injuries occur while preparing for such race or speed contest.

Limit

of Liability

Part A explains that the monetary limit that appears on the policy declarations page is the maximum amount of coverage that will apply to the damages from any single loss. This maximum is not affected by the number of snowmobiles, insureds, or claims involved, nor the number of snowmobiles or premiums appearing on the declarations page. The particulars of a given loss may well affect how payments may be distributed, but the maximum remains the maximum.

Part B of the Limit of Liability section explains that, regardless of whether coverage exists under more than one coverage part (specifically parts A, B and/or C), no duplicate payments will be made under the policy This limitation means that, even if portions of a single claim qualify for coverage under Part C - Uninsured Motorists Coverage as well as Part B - Medical Payments and/or Part A - Liability Coverage, an insured will not be paid more than once for any portion of his loss. This limitation also applies to any coverage available under any underinsured motorists coverage provided by the policy.

Parts C affirms that the snowmobile policy won’t pay for a single element of loss that already has been paid by any party responsible for that loss.

Part D explains that no coverage exists if coverage should be handled by either a workers compensation or a disability benefits law.

Other

Insurance

If other sources of insurance or other policy provisions apply to an uninsured motorist loss, this provision intends to make sure that such sources are contemplated when compensating an insured for a loss. The policy’s uninsured motorist coverage part responds on an excess basis, paying only after the other available coverage has paid its limit.

Arbitration

A. If we and an “insured” do not agree:

If the company and their insured aren’t on the same wavelength regarding whether a loss payment is due and/or how much is due in an uninsured motorist loss, the argument may go to arbitration. However, both the company and the insured may want the disagreement to be handled by representatives of their own choosing. A judge may be called upon to select a third arbitrator if this person isn’t selected by the first two arbitrators within 30 days.

Related Court Case: Section Insurer Must Accept Decision Of Its Approved Umpire - this is a helpful illustration of the power of an arbitration clause.

B. Distribution of costs

Each party will handle their own out-of-pocket expenses, as well as share in the cost of the third arbitrator. The arbitrators must follow the local rules of law in their discussions.

C. Unless both parties agree otherwise

The insurance company and the insured must accept the decisions agreed on by any two arbitrators as legally binding in the areas of determining a valid claim and the amount to be paid. An exception is made if the arbitrated amount is greater than the minimum bodily injury liability established by the applicable financial responsibility law. If this disparity occurs, either the insurer or the insured can insist on going to trial. However, if no party contests the amount within 60 days of the arbitration result, the decision, regardless of the amount, is binding.

PART D - COVERAGE FOR DAMAGE

TO YOUR SNOWMOBILE

This section deals with actual damage to the insured’s covered snowmobile. It includes expenses because of loss of use of the same.

Insuring

Agreement

Under section A of the insuring agreement, the policy agrees to protect “your covered snowmobile” or a “non-owned snowmobile” against accidental loss. Any payment includes compensation for loss to snowmobile equipment but does not include the applicable deductible. If you’re unlucky enough to have more than one covered snowmobile involved in the same collision loss, only a single, highest deductible will count against any loss payment.

|

Example: Barney and Kloorene Runarown have two IcePyscho

snowmobiles that are covered by a snowmobile policy. They also have four

lovely offspring who keep them incredibly busy with their sports and other

activities. One weekend, Barney and Kloorene let the kids use the snowmobiles

on some trails near their home. Unfortunately, two of the kids end up

colliding with each other. While there was $1,200 in damages to one

snowmobile and $1,900 to the other, only a single $250 deductible applied to

the whole loss. |

This section applies only to collision and other than collision losses, but only if the policy’s declarations page shows a deductible choice to indicate that these coverages are in effect. Should a loss involve a non-owned snowmobile, the broadest coverage written for “your covered snowmobile” applies.

Part B of the insuring agreement explains that “collision” refers to your covered or your non-owned snowmobile which has either hit or been hit by another vehicle or some other inorganic item. It’s implied that the event has to result in damage to your snowmobile.

|

|

Example: While parking your snowmobile in front of a ski lodge,

you slam headfirst into a huge snowman. Besides creating a lot of laughter,

no harm is done to your snowmobile, though the snowman’s a fatality.

Collision? Yes. A loss under Part D? No, because nothing insurable was

damaged or destroyed. |

“Other than collision” simply refers to those events that aren’t collision. The policy lists ten events that qualify as other than collision losses. If your covered snowmobile is damaged by items falling from the sky, fire, theft, explosion or earthquake, windstorm, hail or flood, vandalism, rioting, contact with birds and animals, or if glass has broken, you’ve experienced an other than collision loss. The policy is flexible about losses involving glass. If any glass is broken during a collision, an insured may choose to have it covered under the collision portion of the policy.

As just mentioned, the snowmobile policy provides coverage to snowmobiles that, while being operated or used by an insured, aren’t owned by or regularly available to any insured (which includes any “family member”). Another class of vehicle that’s considered a non-owned snowmobile is a temporary substitute. This refers to a snowmobile that takes the place of a covered snowmobile that is unavailable while being repaired, replaced or maintained. The rationale for covering non-owned snowmobiles is that these are temporary situations that don’t typically increase the exposure contemplated by your premium, so the policy should be available to provide protection.

|

Example: You’ve taken your snowmobile down to Mac’s Garage for a

repair after you hit a rock that was hidden by a snowdrift. Mac loans you a

snowmobile to use until your snow chariot is repaired. The next day, you hit

another hidden rock. This is a covered temporary substitute situation. |

|

Transportation

Expenses

An insured can accumulate significant expenses related to the loss of a covered vehicle. The snowmobile policy includes some additional coverages. For instance, the policy will pay up to $30 a day for up to a maximum of $900 to help cover the cost of getting replacement transportation. This coverage is only provided if the covered snowmobile is unavailable due to a collision or other than collision loss. Of course, the declarations page has to show that the applicable coverage has been selected. (09 18 change)

In the midst of this section that provides physical damage coverage lies liability protection. The policy also compensates an insured for legal liability for the loss-of-use expenses for damage to a non-owned snowmobile. This coverage is limited to $30 per day with no mention of a maximum. Of course, this is a small loss exposure, so no other limit may be necessary. (09 18 change)

The snowmobile policy also will cover additional transportation expenses if an owned or non-owned snowmobile is stolen. However, coverage won’t begin until 48 hours after the theft. In all other cases, coverage begins after 24 hours. Coverage ends when the covered snowmobile is available for the insured’s use or a settlement has been made.

Exclusions

Part D - Coverage for Damage to Your Snowmobile will not pay for:

1.

Loss to an owned or non-owned snowmobile that occurs while it is used for hire

to transport persons or goods. This

exclusion has been revised to make coverage intent clearer. It now refers to

the coverage ineligibility when any insured driver is actively using any

vehicle in conjunction with a transportation network platform. Active use means

providing such use as a driver. The exclusion applies both while seeking

passenger contacts and during transporting passengers. (09 18 change)

Besides the long-standing exception that

applies to use of vehicles in traditional pooling arrangements, an additional exception is referenced,

allowing coverage for a vehicle during its use in charity and volunteer

situations. Protection extends to instances of both ownership and operation

during such instances. (09 18 change)

Note: Naturally chances are low that such situations will arise regarding snowmobile use, but the base PAP change will still apply.

2. Damage resulting from your snowmobile’s aging, extremely cold weather, mechanical or electrical breakdown, or road damage. An exception is made for such damage that results from the total theft of a covered auto (owned or non-owned).

|

Example: After trying to start his snowmobile for two hours, Pete

jumps in the snowmobile and the engine dies. He has it towed to |

3. There’s no coverage for any loss caused by radioactive contamination, nuclear weapons, war (including civil war), insurrection, rebellion or revolution.

4. Part D does not cover loss to electronic equipment intended to reproduce sound, including any accessories or related equipment unless the equipment is permanently installed

5. This exclusion bars coverage for such devices as computers, video and audio recorders, scanners, radios of all types, receivers, televisions, telephones, CD players and similar property that is capable of receiving or transmitting audio or video signals unless the devices are permanently installed.

6. This exclusion is for any media (tapes, CDs, records, etc.) that is used with equipment described in exclusions 4. and 5. above as well as any accessories used with equipment that reproduces sound or transmits signals.

7. This exclusion explains that Part D doesn’t respond to a loss of either an owned or non-owned snowmobile that’s destroyed or taken by legal authorities. Of course, an exception is made for the financial interests of loss payees. It isn’t in the public interest to deny protection to lenders because of the illegal acts of their borrowers.

8. There’s no coverage for items owned by an insured, but not listed on the declarations page. Neither is there any coverage for awnings, cabanas (lightweight structures with living facilities) and equipment designed to create additional living facilities including cooking, refrigerating or plumbing equipment.

However, there is coverage for trailers (including their facilities or equipment) that are newly acquired by the insured and which are reported to the insurer within 14 days. The intent of the policy is to make sure that all exposures are reported and rated.

9. Any insured, including a family member, who has a loss involving a non-owned snowmobile will find himself without coverage if he doesn’t believe he has permission to use the snowmobile.

10. Any equipment used to detect or locate radar or lasers is not protected if it is lost or damaged.

11. All custom furnishings and equipment are excluded from coverage.

12. This eliminates coverage for any non-owned snowmobile that is being held or used by any insured while working at selling, repairing, servicing, storing or parking snowmobiles.

13. There is no coverage for any snowmobile used in any type of speed contest or race. Further, there is no coverage if the loss occurs even while preparing for a race. Coverage is denied even if the race or contest was totally spontaneous.

14. Excludes any loss to a non-owned snowmobile (including loss of use) rented by an insured when any applicable state law or rental agreement prohibits a rental company from collecting for any loss or loss of use. In other words, the Snowmobile Policy won’t provide protection when either state law or a rental contract provides that coverage must be part of the rental transaction. Such a legal requirement makes coverage under a snowmobile policy unnecessary.

15. No loss to a covered vehicle applies during the period that both of

the following apply to the vehicle:

a. There is a written

contract under which the vehicle is part of a personal vehicle sharing program

b. That vehicle is

being used by a person other than the named insured or a family member (as

defined) of the named insured who is participating in a program referenced in 12.a

above. (09 18 addition)

16. No coverage extends to claims involving

a non-owned vehicle that involves damage, destruction, or loss of use of that

vehicle when such claims are related to the use of the vehicle under a personal vehicle sharing program. This exclusion

applies when both of the following apply:

·

A non-owned vehicle is used by the named

insured or a family member (as defined) of the named insured

·

No recovery can be demanded from the named

insured or family member due to the parameters of the sharing program’s written

agreement or due to state law. (09 18 addition)

17. This exclusion is also new. It bars

coverage for loss involving flying vehicles, whether flight is their sole

capability or is among their features. (09

18 addition)

Related Court Case: Helicopters Ruled Not To Be "Motor Vehicles"18. Finally, no coverage applies to a snowmobile that a third-party rents or leases.

Limit

of Liability

The snowmobile policy does have restrictions on the total amount of coverage available for a loss to a covered vehicle. Specifically, Part A of Part D - Coverage for Damage to Your Snowmobile - states that the policy is obligated to pay the actual cash value of the lost (stolen or damaged [including total losses]) property or to pay what’s needed to repair or replace the property, whichever is the LEAST EXPENSIVE option. This provision includes the option of settling a loss by using property of like kind and quality. Payment is reduced by the deductible shown in the schedule. When there are multiple covered snowmobiles involved in the same loss only the highest single deductible will apply.

Part B explains that any settlement includes an adjustment for a snowmobile’s decreasing market value (depreciation) and physical condition when determining its actual cash value after a total loss.

Finally, under Part C, if the repair or replacement of a covered snowmobile results in an insured being better off than before the loss, the Snowmobile Policy won’t pay the value of the improvement.

Payment

of Loss

This provision discusses a company’s options in making a settlement on a loss to a covered snowmobile, stating that the settlement may be in the form of a cash payment, a repaired or a replacement snowmobile. The insurer has the option to return any stolen property to the named insured or to the latest address shown on the declarations page. If any property is returned, the insurer must pay for doing so, and only after any damages have been repaired. Further, should the company exercise the right to keep the property, it has to be at a price that’s acceptable to both parties. Finally, if the settlement is made in cash, the total has to include any sales tax.

No

Benefit to Bailee

A carrier for

hire or a bailee for hire is not permitted to benefit under this policy.

Without this provision, the policy would be accessible to parties who haven’t

been rated or underwritten for coverage and for more exposures than

contemplated.

Related Court Case: "Car Wash Assumes Liability When Customer Relinquishes Vehicle For Service"

Other

Sources of Recovery

This provision is to make sure that any payment under Part D takes other sources of loss payment into account. If other insurance policies, provisions or sources of recovery apply to a physical damage loss, the policy will only pay its proportion of the total available coverage. But the proportional payment is only for owned snowmobiles. If other sources of payment exist for a loss, the policy responds on an excess basis. It is excess over every other available source of payment, including the policy of the owner of the snowmobile.

Appraisal

This system works quite similarly to an arbitration clause, except that the only point of dispute is the amount of payment, rather than the amount of payment and/or whether payment is due. This provision may be invoked when the company and the insured don’t agree on the amount of the loss. Each party must select its own qualified appraiser. The two appraisers then select an umpire. The appraisers then submit their opinion of the actual cash value and the amount of the loss. If they don’t reach agreement, they submit this information to the umpire. An agreement by any two persons is binding on both parties.

The company and the insured have to pay for the expenses of their own appraiser, as well as equally share the expenses of the umpire.

|

Example: After a collision loss, Leticia’s insurance company

offers to pay $1,680 for her destroyed snowmobile. Leticia refuses to settle,

saying that her snowmobile was worth at least $5,800. After weeks of arguing,

they agree to submit the claim to an appraisal. After the appraisers and

umpire are selected and they meet for a couple of hours, the appraisers sign

off on an award of $4,350. Leticia must pay for the cost of her appraiser and

also half of umpire and other appraisal process expenses. |

No other insurer rights are affected by their agreeing to an appraisal. For instance, if another party has some responsibility for the loss, the insurer, after paying the appraised amount of loss, may still subrogate the claim.

PART E - DUTIES AFTER AN

ACCIDENT OR LOSS

Up to this point, the policy has been concerned primarily with the duties of the company. This section explains what an insured must do in order to fulfill his obligations once a loss occurs. It is important that these conditions be met, since failing to comply may relieve an insurer from having to pay for a loss.

A. Notification. The insured must tell the company the accident details as soon as possible. The notification may be to an agent, and, ideally, should include the identity and addresses of any people hurt in the accident, as well as accident witnesses.

Item A is critical, since it initiates the entire claims process, and it gives the insurer its first and best opportunity to control the expense of the claim.

B. If an insured wants coverage, he/she must:

1. Assist the insurer in the claim’s investigation and settlement, as well as help with defending against any claim or suit.

2. Immediately send the company copies of ANY material received that’s related to the accident.

3. Agree to attend as many:

a. physical exams, involving doctors selected by the insurer and/or

b. interviews under oath

as are reasonably requested by the insurer. These requirements are at the insurer’s expense.

4. Permit the insurer complete access to medical and other records that relate to the accident.

5. Give the insurer any requested proof of loss.

The conditions under item B allow an insurer to evaluate whether a loss payment is due and how much has to be paid. This area has a lot of potential for straining relations between the insurer and the insured, since the two parties may differ over what is “reasonable.” The insured may quickly become concerned with their privacy, as well as their community standing. It is important that this provision spells out an insured’s contractual obligations in order to document their cooperation and possibly mitigate any hard feelings over repeated requests for help or information.

Related Court Case: Insured Fails To Cooperate

C. If the loss involves uninsured motorists coverage, the insured is further obligated to notify the police quickly if the accident was caused by a hit-and-run driver, and to send the insurer copies of any legal papers should a suit be filed. Hit-and-run losses are always difficult to investigate and are always favorites for exaggerated, inaccurate or fraudulent claims. The requirement that such losses be immediately reported to the police is a way to guard against claim problems.

D. If the loss involves collision or other than collision coverage, the insured is further obligated to:

1. Protect their property from further loss. The company is obligated to reimburse the insured if any additional expense is involved.

2. Quickly notify the police if the covered snowmobile is stolen.

3. Allow the company to inspect and evaluate the damage property BEFORE it is repaired or removed.

Preserving the damaged property after a loss is extremely important.

In the last instance, having any damage repaired or getting rid of the damaged property is an extremely serious breach of contract on the part of the insured, and could easily result in an insurer’s refusal to make payment. If the insured snowmobile is repaired or disposed of, the insurer has no chance to evaluate whether coverage was due, nor determine how much was due.

PART F - GENERAL PROVISIONS

Bankruptcy

This provision says that an insured’s bankruptcy or insolvency doesn’t release the company from any obligations under this policy. This fact appears clear enough. But what happens if an insured can prove that his bankruptcy prevented payment of the policy premium in time? In such instances, the courtroom may be the only way to resolve the issue.

Changes

A. This states that the policy is a complete agreement that can’t be changed, except by the company issuing an endorsement.

This is important. If the insured were allowed to change the policy, the most common changes would involve waiver of premiums for life, guaranteed renewals and unlimited liability limits. Note that, from a consumer’s point of view, these wouldn’t be good policy features; it’s just that the provisions would make it a little tough to earn a profit. Fortunately, insurers are eager to help their customers make valid changes to their policy to fit their current circumstances.

B. The second part of this provision explains that the policy premium was based on a certain set of facts. If any of this information changes, it could affect the rating of the policy, and the insured’s premium may be changed. Items that could cause the policy’s cost to change include the number, type or use of snowmobiles; the operators; where the snowmobiles are kept; and coverage, deductible or limit changes.

Finally, part B of the changes provision makes a reference that falls outside of the policy. It states that if a rating change is necessary, the change will be performed in compliance with the applicable company’s filed rating plan and rules.

C. This part of the provision is a liberalization clause for the benefit of consumers. If a company does something to expand coverage without charging additional premium, then the change immediately applies to all similar parties in a given state. This provision does not apply in instances where changes both expand and restrict coverage.

|

Example: On May 1st, Company A amends the snowmobile

policy to provide theft protection for windshield farings for up to $1,500,

free of charge. Effective May 1st, policies that don’t renew until

after May 1st automatically get this additional, valuable

protection. |

Fraud

This provision is particularly brief and straightforward. The insurer advises that, if an insured speaks or acts with the intent to mislead others regarding any loss or claim, the insurer can deny coverage. Of course, this part of the insurance contract is implied throughout the policy. Naturally, the wording does nothing to deter fraudulent activity.

Legal

Action Against Us

This provision stands as a tool to make a lawsuit the last recourse to resolving a dispute between the 1st and 2nd parties to the contract. The provision forces the parties to use all of the tools within the policy before a suit is attempted. In other words, an insured, disputing the existence of liability or the amount that should be paid, cannot skip arbitration or appraisal or cooperation with the company or providing proof of loss, etc., and go straight to filing a suit. Further, even after compliance with all of the policy provisions has occurred, no action can be filed unless there’s been a written agreement that the “insured” is responsible for a loss payment OR the amount of the payment has been settled via judicial proceedings.

Part B of this provision denies any person or organization’s right to bring action against the insurer to determine if the “insured” is liable for an accident. This part is needed to limit the persons who may rightfully expect performance under the contract. Without this clause, the policy would provide protection to parties who, rightfully, should secure their own coverage.

Our Right

to Recover Payment

This provision specifically states that, while an insurer will fulfill any valid obligation to make payment under the policy, when payment is made, it acquires the insured’s right to recover payment from another responsible party. Just as important as acquiring this right is the duty it imposes on the insured. The insured must cooperate fully with the insurer to pursue recovery AND must be certain that he or she does nothing to undermine this right. However, this provision doesn’t apply under Coverage Part D when the responsible party is a person who operates the covered snowmobile with an insured’s permission.

|

Example: James files a hit and run accident that, apparently,

occurred to his parked snowmobile. His insurer has his snowmobile repaired. A

couple of weeks later, Teri, James’ friend, confesses that she hit his

snowmobile while carousing in her snowmobile. Since he knows that Teri has no

insurance (they’re friends and James has already had his snowmobile fixed),

he keeps this information a secret. James’ decision is a SERIOUS breach of

the “Our Right To Recover Payment” provision. He has shielded the responsible

party from criminal and civil responsibility, preventing the insurer from

seeking reimbursement or legal action against Teri. If the insurer found out,

they could seek damages from James. OOPS, almost forgot - the police probably

wouldn’t mind talking to James about his decision. |

|

Part B of this provision explains that if the company compensates the insured for a loss and then collects payment from the responsible party for the same damages, the insured HAS to hold onto the money on behalf of the insurance company and then reimburse the company up to the amount of the settlement.

|

Example: Let’s say that in the immediate example, James’ friend

Teri comes along and confesses to the hit-and-run, goes to the police and

accepts her legal probation and fine, and then gives James money to pay for

the damages. To comply with the policy provision, James must hold the money,

tell his company about the payment, and forward part or all of it to the

insurer (depending upon whether Teri’s payment is less or greater than the

company’s settlement). |

This duty of both parties regarding subrogation has been long established.

Related Court Case: Subrogation Examined In Automobile Claim (Classic)

Policy

Period and Territory

In order for

the snowmobile policy to apply to a loss, the loss must happen within the

policy period shown on the declarations page and within the territory shown.

The territory described in the policy includes the

Termination

This provision addresses both cancellation and non-renewal of a snowmobile policy. However, a detailed discussion of this topic is fairly academic, since it may be the most frequently amended or replaced policy provision. This provision is necessary due to various state requirements, as well as individual company preferences. It is critical to keep in mind that state and company rules are what must be followed when terminating a customer’s coverage.

A. CANCELLATION

The insured has it simple. All she or he has to do is either return the policy to the company or send prior written notice of the date the policy is to be canceled. The insured can request cancellation at any time during the policy period.

It’s a little more complicated for the insurer to cancel coverage. The company has to mail written notice to the named insured at the address shown on the policy declarations page. The insurer must give 20 days’ advance notice of cancellation, unless the cancellation is for not paying the premium or if it is done within the first 60 days of coverage (new business). In the latter instances, the insurer may give 10 days’ advance notice.

After new business has been in effect for 60 days or after a renewal of a continued policy, cancellation may take place only for nonpayment of premium or after the license of the named insured or a regular driver of the covered snowmobiles is suspended or revoked. Any suspension or revocation must have occurred either during the last policy period or, if the policy period is other than annual, since the last anniversary date. Another reason for cancellation is any significant misrepresentation set forth to get coverage.

Related Article: Auto Cancellation and Non-Renewal Time Requirements

Note: A misrepresentation has to be important enough to affect a company’s decision to accept coverage. Minor items may call for premium adjustments, but not cancellation. For example, finding out that the insured gave you a wrong model year or name isn’t an important misrepresentation. The fact that he or she hid their recent conviction for serial vehicular homicide is kind of important and sending a legal notice of cancellation would be justified.

B.

NON-RENEWAL

This option to end coverage is just a company privilege. However, if an insured sent in advance a written notice not to renew coverage at the policy’s expiration date, it technically would be an insured’s request to non-renew.

In any case, if a company doesn’t want to continue coverage, it has to give an insured at least 20 days advance notice of non-renewal. If the policy period is less than six months, coverage may be non-renewed at any six-month period after the anniversary of the original effective date. If the policy period is annual or longer, the policy may be non-renewed at any anniversary. As with the cancellation provision, many states and companies vary from this portion of the policy. Further, for both cancellations and non-renewals, many states require that the legal notice includes the reason for the action and any available recourse.

Related Article: Auto Cancellation and Non-Renewal Time Requirements

C.

AUTOMATIC TERMINATION

This section of the termination provision allows for coverage to end without any written request or notice being required. If a company sends a renewal policy, and if the insured or insured’s representative doesn’t accept it, coverage ends at the latest expiration date. Nonpayment of the renewal premium is considered non-acceptance. If an insured obtains another insurance policy, coverage automatically terminates at the effective date of the replacing coverage.

D.

OTHER TERMINATION PROVISIONS

Part D of the TERMINATION provision informs the insured that a cancellation notice may be delivered or mailed and that proof of mailing acts as sufficient proof of notice. IMPORTANT: Many states mandate how the notice has to be delivered (for instance, registered or certified mail), so you need to be aware of state law and any form that amends or replaces this provision.

The insured is also told that the company may be refunding the premium if a policy is canceled, but that the refund transaction has no effect on the cancellation. In other words, an insured may not claim that, after receiving legal notice as well as any other notification requirements, the cancellation is voided because of a delay in returning the premium.

Transfer

of Your Interest in This Policy

A policyholder can assign his rights and duties under the policy to another person, BUT ONLY with the written permission of the insurer.

There is one exception to the rule of having to get the insurer’s permission to assign a policy. If the policyholder dies, this policy provision automatically transfers coverage either to a surviving spouse (if he or she lives at the same address) or the deceased’s legal representative. Either party achieves the status of named insured. However, the legal representative is protected only to the extent of his/her duties to maintain or operate the covered snowmobiles.

The insurer will only recognize such a transfer until the policy’s expiration date. The working assumption is that appropriate coverage reflecting the change in circumstances will be obtained or that coverage will either be terminated or allowed to expire.

Two or

More Policies

The final provision of the policy is important. What happens if the insurer issues more than one policy to a named insured, and all of the policies are available to respond to the same accident? Simple enough: this provision designates the company’s total liability to its insured. The total amount that the company is obligated to pay equals the highest limit of insurance written under any single, applicable policy.

|

Example: Ober N. Shord owns a ’12 Snomaster that is insured by Slumbertyme Mutual. Their underwriters must have been asleep because Ober ended up with three policies applying to the same, at-fault collision. Slumbertyme’s policies had the following coverages and limits: |

||||

|

Coverage |

Policy A |

Policy B |

Policy C |

Policy Limit Totals |

|

Bodily Injury |

$25,000/$50,000 |

$250,000/$500,000 |

$100,000/$300,000 |

$375,000/$850,000 |

|

Property Damage |

$25,000 |

$250,000 |

$100,000 |

$375,000 |

|

Medical Payments |

$3,000 |

$10,000 |

$5,000 |

$18,000 |

|

Uninsured Motorist |

$15,000/$30,000 |

$100,000/$300,000 |

$25,000/$50,000 |

$140,000/$380,000 |

|

Although it might be a comfort to Ober and the person, he injured to have the insurance limits added together (stacked), the Two Or More Policies provision prevents this scenario. In this instance, Slumbertyme’s total possible obligation is limited to the insurance limits shown under Policy B above, the highest single set of limits. The limits may not be combined in any way to increase coverage beyond the limits available under a single policy. |

||||

Related Court Case: Insured Not Permitted To Stack UIM Benefits

Note: There are states that, depending upon circumstances and coverages, permit stacking; therefore, applicable state law is always relevant.

Menu (click here to expand or to collapse)

Menu (click here to expand or to collapse)